Market Strength: Why Roanoke Rapids

📍 Strategic Location Advantage

Roanoke Rapids is strategically positioned along Interstate 95 (Exit 173), making it a highly accessible corridor market for employment, logistics, and long-term rental demand.

- ~1 hr 15 min to Raleigh, NC

- ~1 hr 30 min to Richmond, VA

- Direct access to a major East Coast transportation artery

This location supports both local workforce housing demand and regional economic connectivity, while maintaining lower acquisition costs than major metro areas.

🏭 Employment & Economic Drivers

Roanoke Rapids benefits from a stable, diversified employment base that supports consistent rental demand:

- ECU Health North Hospital – the region’s primary healthcare employer

- Manufacturing, logistics, and packaging facilities

- Strong blue-collar workforce with long-term tenancy patterns

These industries create recession-resistant rental demand, particularly for affordable and workforce housing.

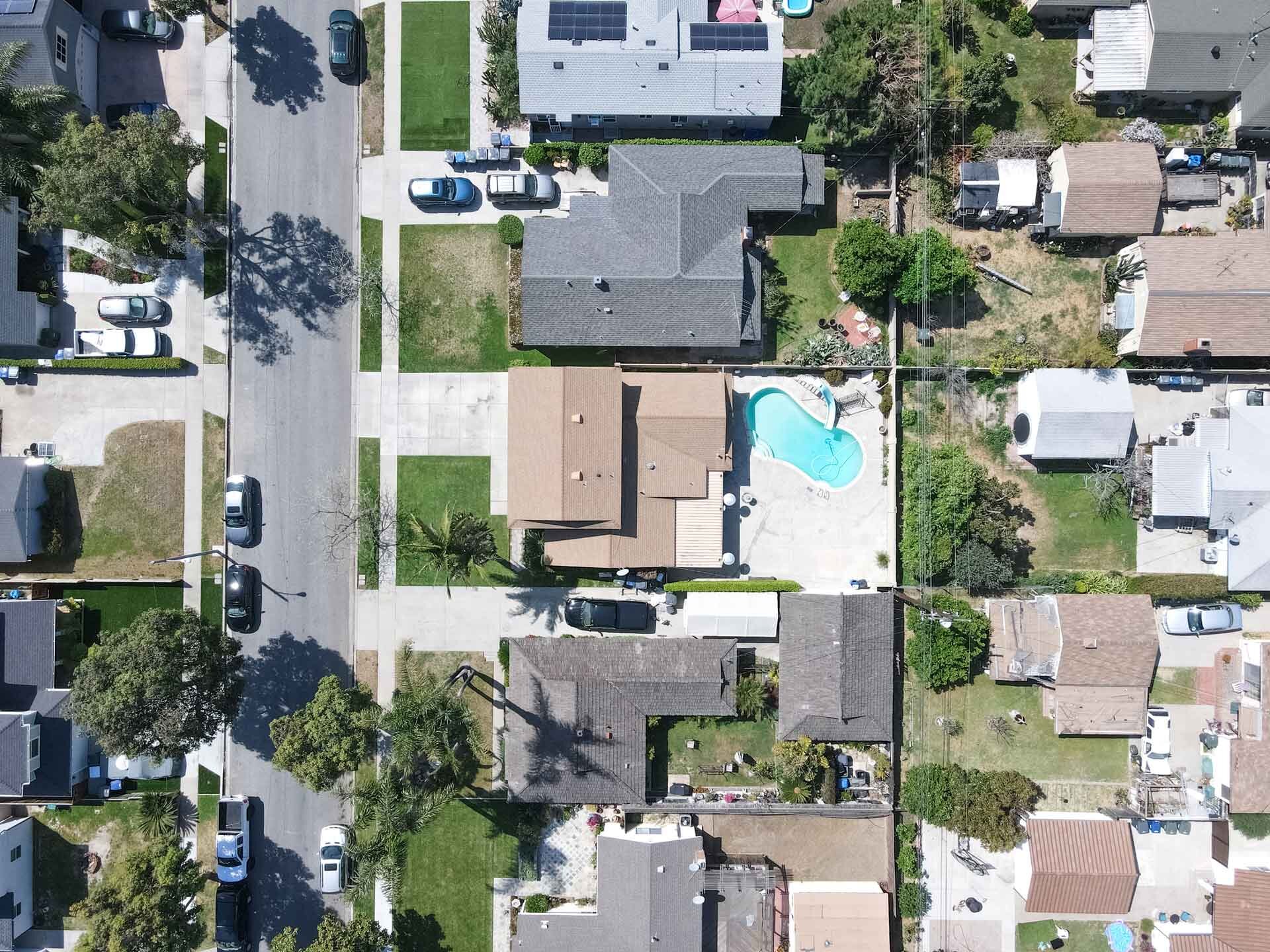

🏘️ Tenant Demand Fundamentals

The local housing dynamics strongly favor rental ownership:

- Median Rent (27870): $975 – $1,250/month

- ~50% renter-occupied households

- Walkable neighborhoods with nearby parks, schools, and amenities

- Small-town affordability attracting long-term tenants

This market supports high occupancy, lower turnover, and predictable cash flow when assets are properly stabilized.

Things to Do in Roanoke Rapids, NC

Beyond the numbers, Roanoke Rapids offers a quality of life that supports long-term tenant retention and stable occupancy.

Residents benefit from access to outdoor recreation, local entertainment, healthcare, schools, and everyday conveniences—all within an affordable, small-town environment.

The attractions highlighted below contribute to the livability of the area, making it an appealing place for workforce tenants to live, work, and stay.

🔁 Exit Strategy Flexibility

Roanoke Rapids offers multiple viable exit paths, allowing investors to adjust strategy as market conditions evolve:

1. Long-Term Hold

- Stabilize and refinance via DSCR loan

- Extract equity while maintaining cash flow

2. Individual Retail Flips

- Cosmetic rehabs

- $80k – $125k ARVs per unit

3. Institutional / Portfolio Sale

- Increase NOI

- Package stabilized assets for resale to yield-focused buyers

📘 Financial Snapshot

| Metric | As-Is | Stabilized |

|---|---|---|

| Monthly Income | $2,275 | $7,700 |

| Annual Gross Income | $27,300 | $92,400 |

| Net Operating Income | -$1,500 | $63,600 |

| Cap Rate (Unlevered) | Negative | ~16.96% |

| Gross Rent Multiplier (GRM) | 13.74 | 4.06 |

| Estimated Equity (ARV) | — | Up to ~$410,000 |

Click Here for more Financial Snapshot for Roanoke Rapids

✅ Buyer Packet Includes

Qualified buyers receive a full diligence package, including:

- 📊 Pro forma & rent roll spreadsheet

- 📸 Photos & video walkthroughs (available upon request)

- 🧾 Address-level tax & insurance estimates

- 📈 Fair Market Value comps & rental analysis

- 📝 Deal structure & contract terms